Financial Planning

Pointing you in the right direction: forward

Breathe easy knowing WayFinding will provide the clarity, flexibility, and support you need to confidently build your financial plan.

Interactive Retirement Planning

Clearly illustrate multiple scenarios, stress tests, and more. See how different scenarios can change the way you view your retirement.

Tax-Efficient Strategies

Easily see how to save money with an optimal tax-efficient distribution strategy, showing you different withdrawal schedules and Roth conversions in a way you will truly understand yourself.

Social Security Optimization

See how to maximize your Social Security Income. Helping you make the big decision, like when to start receiving benefits.

Budgeting Tools

Providing you tools to help manage your budget, track spending in various categories, and manage expectations for future spending.

Student Loan Management

Use our unique student loan module to illustrate different scenarios so you can reduce payments. Helping ease the burden of student debt for yourself.

Insurance Needs Evaluation

Help protect yourself in the event of situations such as disability or death. Evaluate your needs in different situations and identify ways to ensure your success.

No Investing Experience? No Problem

We keep it simple.

Set up your account in just a few minutes and easily track your returns through the Wealthfront app.

We help minimize risk.

We invest your money in a diversified portfolio across different sectors to minimize your exposure to risk of dips in the market.

We do the busywork.

Our automation manages the trading so your portfolio is always up to date and earning you as much it can.

Demystified Estate Planning

Learn how your assets flow at the end of life, including any possible estate tax ramifications. Replace your anxiety with the peace of mind, knowing your assets are in order.

Account Aggregation

Bring together your bank accounts, credit cards, and externally-held investment accounts all in one place. It’s finally easy to see the full financial picture.

Streamlined Client Onboarding

Get started with your financial plan – easy as 1, 2, 3

1. Create and account

2. Use the guided process to enter your financial data

3. View and track your net worth, income, and spending

Wealth Management

Wealth Management

Wayfinding Financial is invested in You

Our Process

Let's build your wealth together

Starting with every Investor is unique. That’s why at Wayfinding Financial we work to identify all the ways in which your financial goals and objectives are encompassed in order to navigate you along the way. Our teams approach involves four stages:

Orientation

No matter what stage you are in your life, we start with establishing a more detailed understanding of you, to build a closer relationship. By gathering and reviewing detailed information your long-term financial goals and objectives will be determined to set the foundation of your desired destination.

Development

Our goal is to make sure your financial goals and objectives are in line with your expectations. Once we have a thorough understanding of what you want to achieve we can implement a personalized plan that allows us to measure, track, and update as life changes.

Selection

Our desciplined investment approach is the foundation in implementing and maintaining your personalized plan. We have built a wide range of portfolios designed to help clients like you meet their financial goals.

Monitoring

We do not stop once your plan is in motion. Continues monitoring and updating to address economic and market conditions, changes to your long-term goals, and unexpected "Life" events are essential to your long term success. Life is unpredictable and always changing that is why we engage regularly to adapt your plan as life unfolds.

The Wayfinding Approach

Expanding on the options traditionally available to individual investors, we are able to better customize portfolios to meet each client’s unique needs.

Asset allocation

Today’s well-diversified portfolio go beyond traditional stocks and bonds, often including alternative assets. This adds complexity to the portfolio consturction process.

We assess each asset-class sleeve separately, managing complexity and ensuring risk and reward is managed within each dimension of the portfolio.

Investment selection review

- We customize our approach to suit your needs. Whether you hire us to manage a diversified portfolio or to focus on a particular area, our nimble approach is designed to be dynamic to your goals.

- We help you steam-line the investment process by monitoring current asset managers and finding new investments opportunities.

Risk management

- With our industry-leading analytical tools, we offer a comprehensive risk assessment including multi-factor analysis, stress and scenario testing, and other key metrics for a full picture.

- Our expert advisors can deliver tailored data interpretation for your risk/reward thresholds.

Information Security

Your personal information is safeguarded through an information security technology stack that offers 2-factor authentication as well as password and end-to-end email encryption.

Digital Onboarding

We streamline the onboarding and information gathering process through digital platform that pre-populates information and eliminates the hassles of physical paperwork.

Real-Time Portfolio Access

You get access to a consolidated view of your global portfolio in real-time via performance software that is customizable and can be conveniently viewed via desktop, mobile, or tablet.

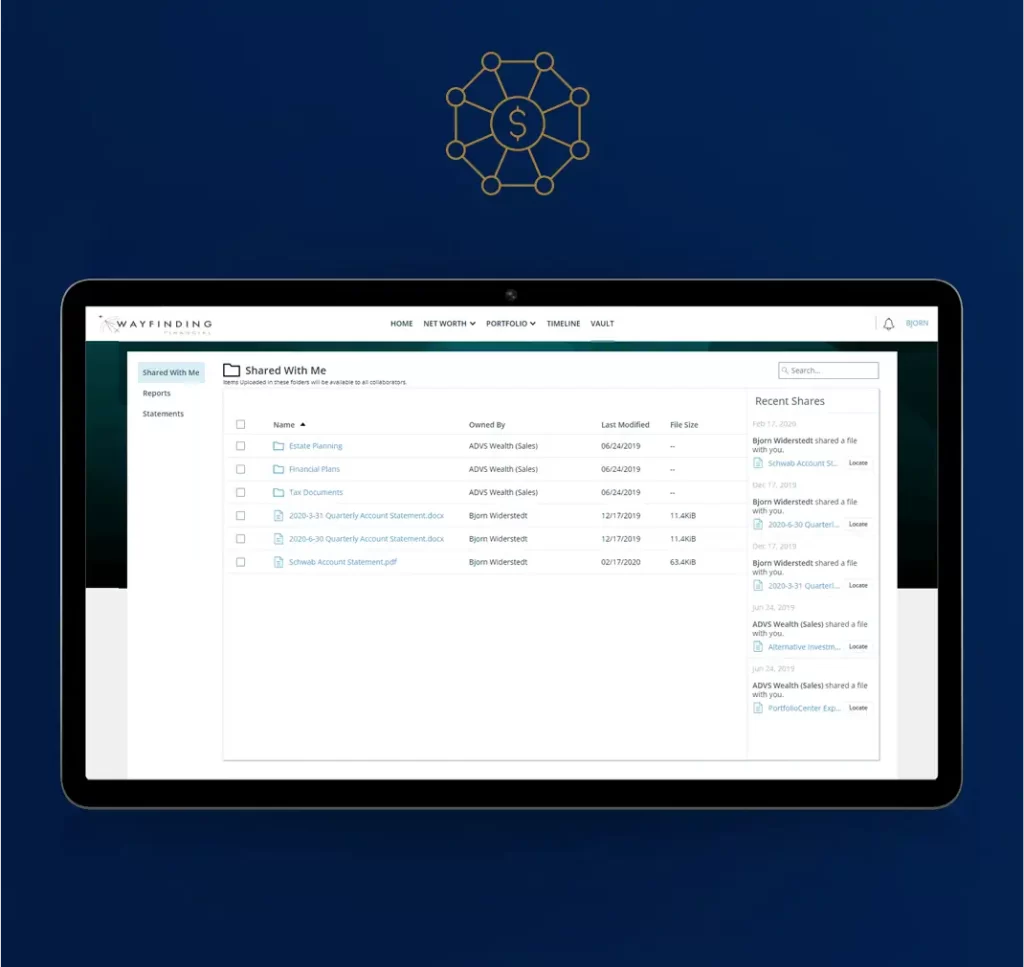

Document Vault

Our online document vault syncs with your accounts to consolidate tax documents such as K-1s and 1099s in a location that is easily accessible for you and your tax advisor.

Guided Investing

Built To Make Investing Easy

Automated technology is how we make investing easier, better, and more accessible.

Here’s what easy looks like:

1. Create an Account.

Everyone’s financial situation is different. Get personal recommendations based on what you want to accomplish, whether that’s retirement or simply building wealth.

2. Choose how you want to invest.

Pick one of our diversified portfolios that interests you. They’re built by experts using low-cost exchange-traded funds.

3. Let us handle the hard stuff.

Automated trading, rebalancing, and dividend reinvestment, we put our technology behind every dollar you invest.

Your investing portfolio made easy.

We custom-build our portfolios with low-cost, diversified ETFs (no more blindly chasing hot stock tips). We’ll recommend one for you and automatically adjust your portfolio as new and better funds become available.

Automated investing helps remove the hassle.

Automated investing helps remove the hassle. Once you deposit, we automatically invest in the market. No holding accounts or manual steps. Plus, our algorithms continually monitor and manage your portfolio at a fraction of the cost of a traditional advisor.

Portfolio rebalancing

We keep your account at your preferred ratio of stocks to bonds.

Dividend Reinvesting

We use dividends to balance your portfolio and help avoid static cash.

Recurring Deposits

You can automate your deposits on your preferred schedule.

Automated investing helps remove the hassle.

Automated investing helps remove the hassle.

Once you deposit, we automatically invest in the market. No holding accounts or manual steps. Plus, our algorithms continually monitor and manage your portfolio at a fraction of the cost of a traditional advisor.

Tax loss harvesting

We can automatically sell holdings experiencing a loss to help offset taxes.

Tax Coordination

Our automated asset location tool places your holdings in tax-advantaged accounts.

Tax Impact Preview

See how much you might have to pay in taxes before withdrawing.